hotel tax calculator nc

C1 Select Tax Year. Single Head of Household.

State Taxes In Every Us State And Dc Ranked Lovemoney Com

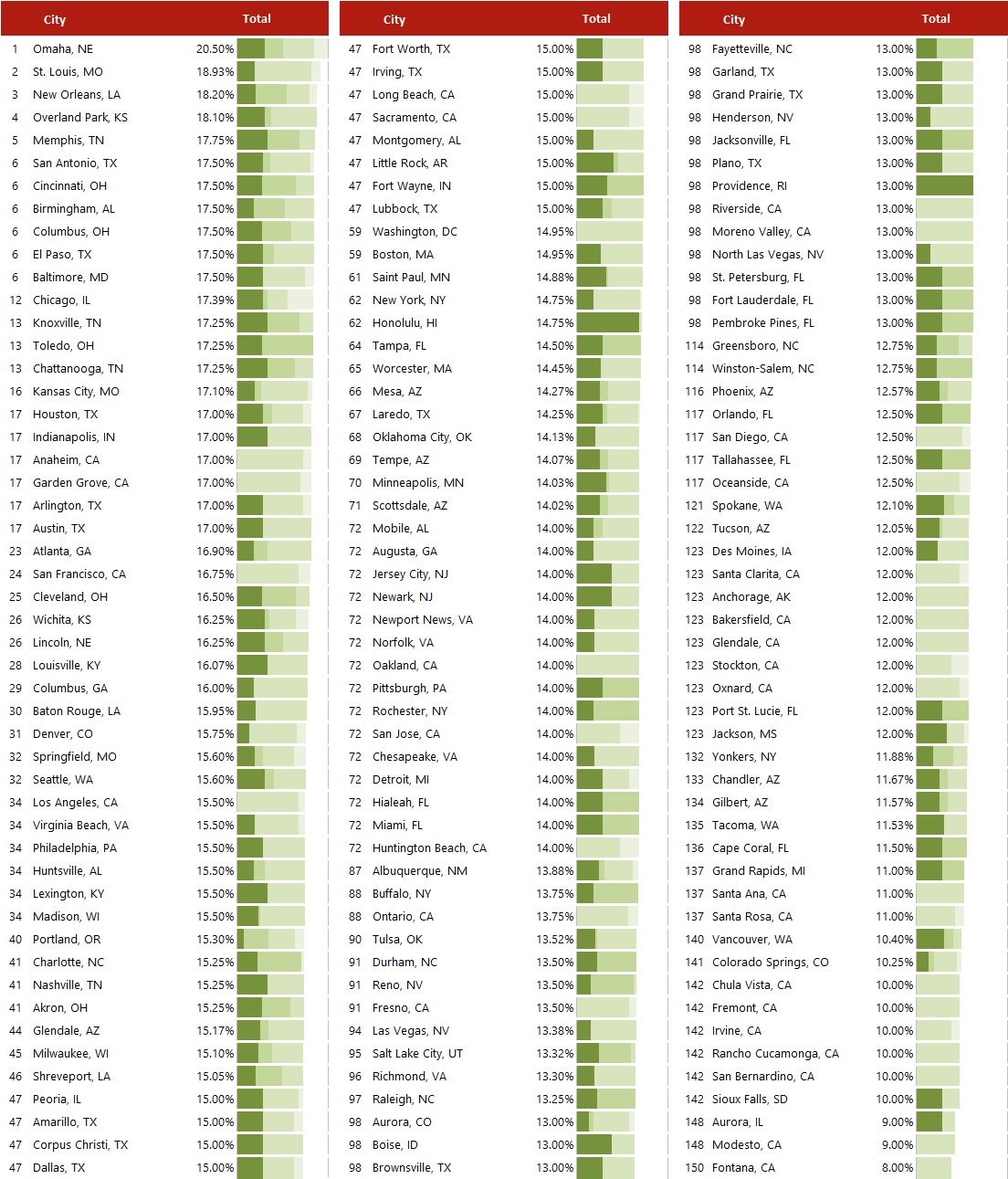

Currently the hotel tax adds 6 to the 7 sales tax for a total of 13 for each night visitors spend in a hotel in the county.

. 54 rows Convention hotels located within a qualified local government unit with 81-160 rooms rate is 30 and 60 for hotels with more than 160 rooms. Overview of North Carolina Taxes. In 2013 the North Carolina Tax Simplification and Reduction Act radically changed the way the state collected taxes.

For comparison the median home value in North Carolina is. Putting everything together the. The economy in the Tar Heel State is very diverse and the key sectors are manufacturing financial services and aerospace.

North Carolina Income Tax Calculator. North Carolina Salary Tax Calculator for the Tax Year 202223 You are able to use our North Carolina State Tax Calculator. The individual income tax estimator helps taxpayers estimate their North Carolina individual income tax liability.

Salary Paycheck Calculator North Carolina Paycheck Calculator Use ADPs North Carolina Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Maximum Local Sales Tax. To use our North Carolina Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

DEC 23 2021. North Carolinas property tax rates are relatively low in comparison to those of other states. Hotel tax calculator nc Saturday October 8 2022 Edit.

North carolina has not always had a flat income tax rate though. Additional sales tax is then added on depending on location by local government. North Carolina State Sales Tax.

Alabama state tax on lottery winnings in the USA. Rentals of Hotel Rooms. Maximum Possible Sales Tax.

North Carolina Property Tax Calculator. All other hotels with. Of that 6 15 funds the Tourism Product.

C2 Select Your Filing Status. North Carolina now has a flat state income tax rate of 525. The median household income in the state is 62891 2021.

The North Carolina Tax Calculator. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Gross receipts derived from the rental of an accommodation and the sales and use tax thereon are to be reported to the Department on Form E-500.

Our calculator has been specially developed in order to. Estimate Your Federal and North Carolina Taxes. Average Local State Sales Tax.

Overview of North Carolina Taxes. The base level state sales tax rate in the state of North Carolina is 475. Your average tax rate is 1198 and your.

PO Box 25000 Raleigh NC. North Carolina Department of Revenue. The average effective property tax rate in North Carolina is.

North Carolina Income Tax Calculator 2021 If you make 70000 a year living in the region of North Carolina USA you will be taxed 11498. North carolina state sales tax. The act went into full effect in 2014 but before then North Carolina had.

After a few seconds you will be provided with a full. You can also get knowledge about the taxes applied to your winnings using a lottery tax calculator.

Sales Tax Rates Additional Sales Taxes And Fees

Honolulu Property Tax Fiscal 2022 2023

Michigan Levies A Total Tax On Lodging Of 12 Fifth Highest In U S Michigan Thecentersquare Com

Hvs 2020 Hvs Lodging Tax Report Usa

.jpg)

Hvs 2021 Hvs Lodging Tax Report Usa

State Tax Rates Comparison Property Sales Income Social Security Tax

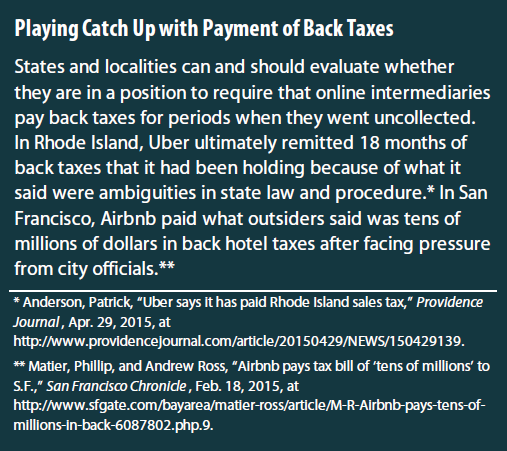

Taxes And The On Demand Economy Itep

North Carolina 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Louisiana Remains Near The Top Nationally For Its Combined Sales Tax Rate Louisiana Thecentersquare Com

.jpg)

Hvs 2020 Hvs Lodging Tax Report Usa

How High Are Spirits Taxes In Your State Tax Foundation

Honolulu Property Tax Fiscal 2022 2023

Sales Taxes In The United States Wikiwand

North Carolina Sales Tax Calculator And Local Rates 2021 Wise

Corporate Tax Rates By State Where To Start A Business

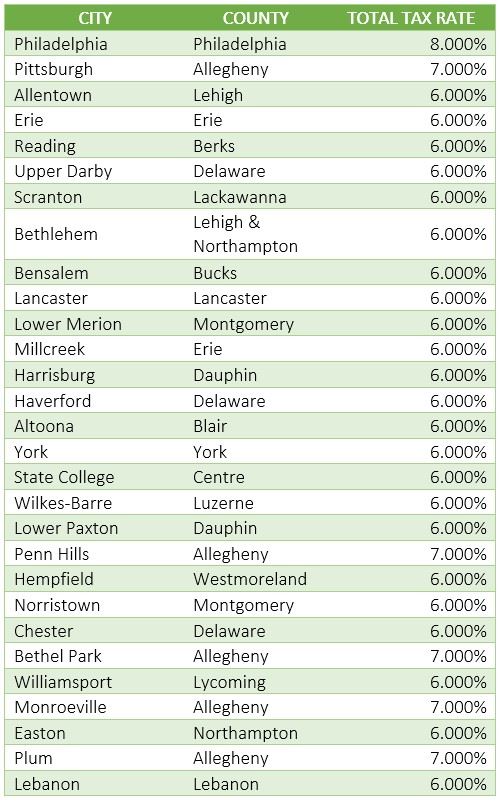

Pennsylvania Sales Tax Guide For Businesses

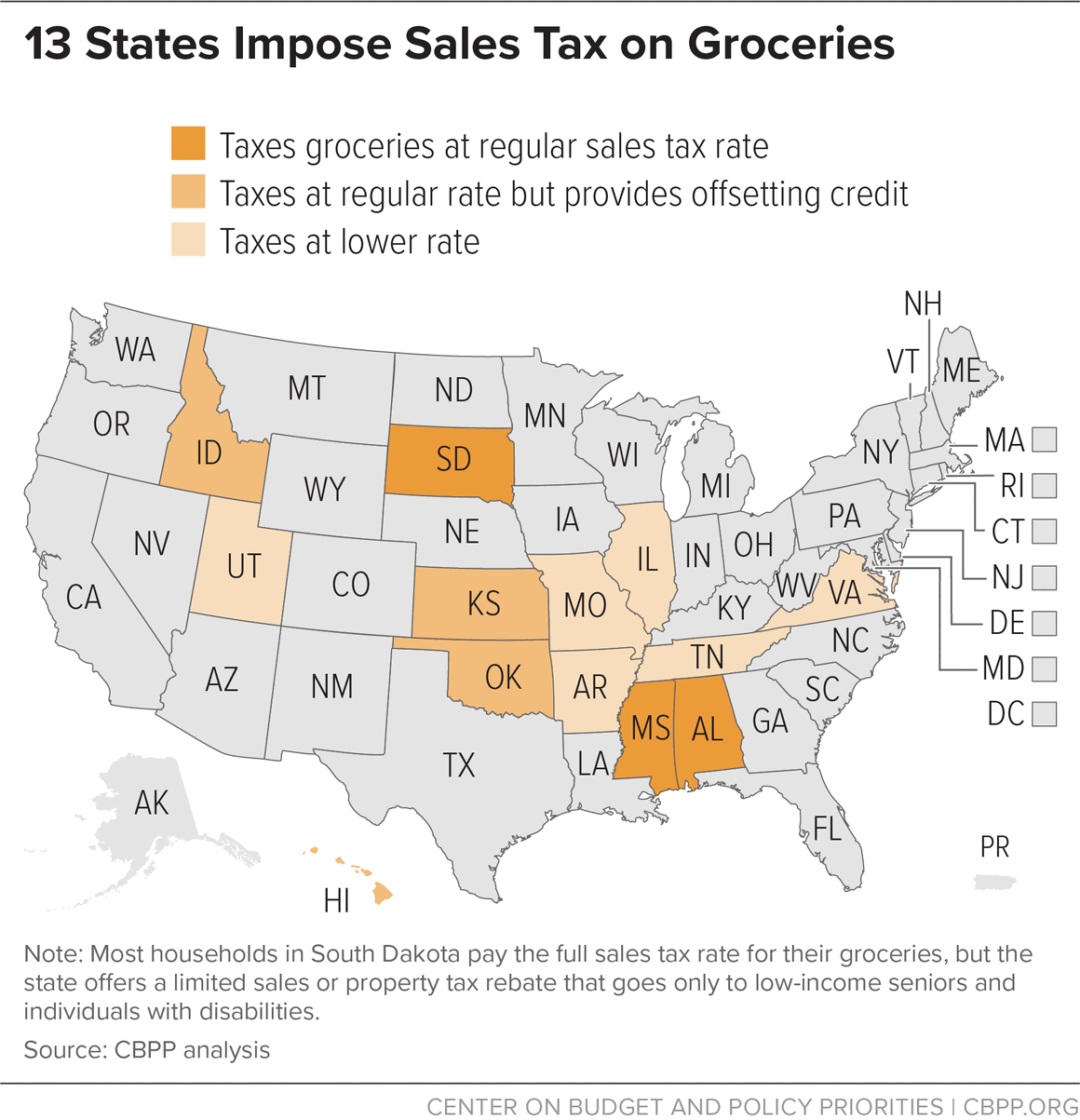

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Room Tax Proceeds Are At All Time High In Highlands Plateau Daily News